New Delhi: Providing a window to black cash holders, the govt on Monday proposed to require a total tax, punishment and additional charge of 50 for every penny on the sum stored post demonetisation while higher duties and stiffer punishment of up to 85 per cent penny anticipate the individuals who don’t unveil yet are gotten.

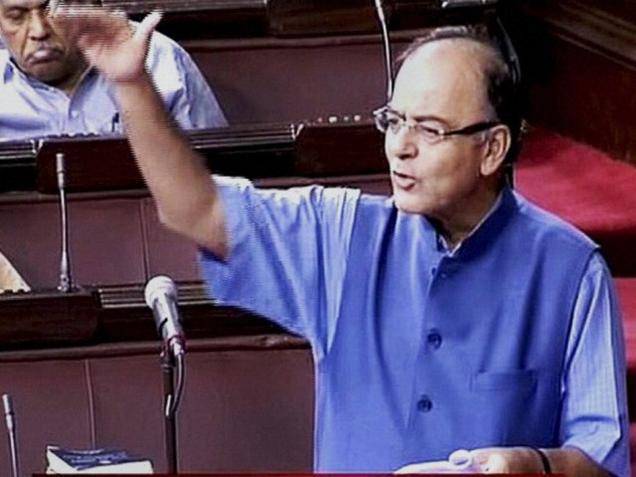

Almost three weeks after Prime Minister Narendra Modi reported throwing out high group 500 and 1000 rupee notes, Finance Minister Arun Jaitley acquainted a bill with change the Income Tax law which additionally accommodates dark cash declarants a compulsorily saving of 25 for each penny of the sum revealed in hostile to neediness conspire without premium and a four-year secure period.

The individuals who announce their evil gotten riches stashed till now in banned 500 and 1000 rupee notes under the Pradhan Mantri Garib Kalyan Yojana 2016, should pay a tax at the rate of 30% of the undisclosed salary.

Also, a 10 for every penny punishment will be required on the undisclosed wage and additionally an extra charge called PMGK Cess at the rate of 33% penny of expense (33 % of 30 %).

Promote, the declarants need to store 25 percent of the undisclosed pay in a plan to be advised by the legislature in counsel with the Reserve Bank of India (RBI).

The cash from the scheme would be utilized for undertakings as a part of the water system, lodging, toilets, framework, essential training, essential wellbeing, and vocation so that there are equity and fairness, said the Statement of Objects and Reasons of the Bill.